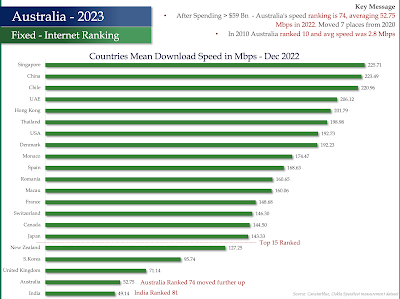

Big Mac Test for Price Check on Internet Services in Australia

Big MacTest for Price Check on Internet Services in Australia The Big MAC Index test is a well-known benchmarking tool to test the price parity of services across the globe. Applying the same to high-speed internet available in the UK, New Zealand and Australia, it has become obvious that Australians pay more for similar speed in comparison to the other two countries. Source: Economist.com