Amazon Flywheel Phenomenon - AWS is The Crown Jewel

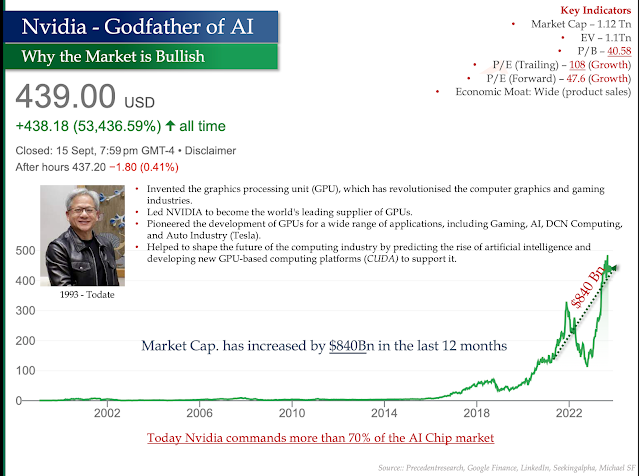

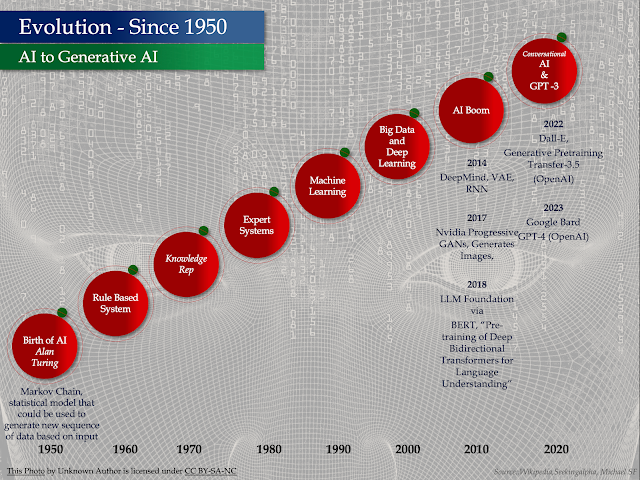

Amazon Flywheel Phenomenon - Why AWS is The Crown Jewel -- Amazon Evolution Where is the Growth Amazons Flywheel Phenomenon Amazons Multiple Flywheels AWS The Crown Jewel Amazon Chasing new Flywheel My other posts on Generative AI and Strategic Analysis of Key Players AI Value Chain Microsoft the King of AI in Software , Salesforce under the AI Cloud Tesla - It's not a Car, Its an AI Device on Wheels Google the King of Search - What the Future Beholds in the AI World Nvidia Godfather of AI - Why the Market is Bullish Generative AI can transform Telecoms , Energy and Utilities Source: SeekingAlpha , Bloomberg , Martinfowler.com , Databricks.com , Nvidia , Google , AWS , Fourweek MBA Blog , Amazon , Ashwath Damodaran , TSMC