TPG Heading for a Challenging Future

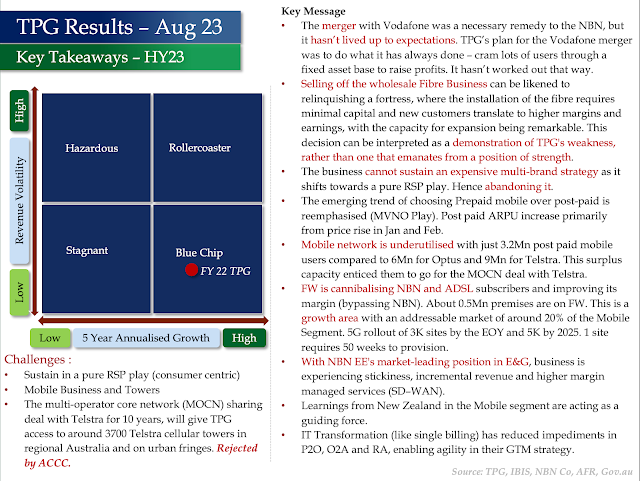

HY23 Results - Key Takeaways

-

- The merger with Vodafone was a necessary remedy to the NBN, but it hasn’t lived up to expectations. TPG’s plan for the Vodafone merger was to do what it has always done – cram lots of users through a fixed asset base to raise profits. It hasn’t worked out that way.

- Selling off the wholesale Fibre Business can be likened to relinquishing a fortress, where the installation of the fibre requires minimal capital and new customers translate to higher margins and earnings, with the capacity for expansion being remarkable. This decision can be interpreted as a demonstration of TPG's weakness, rather than one that emanates from a position of strength.

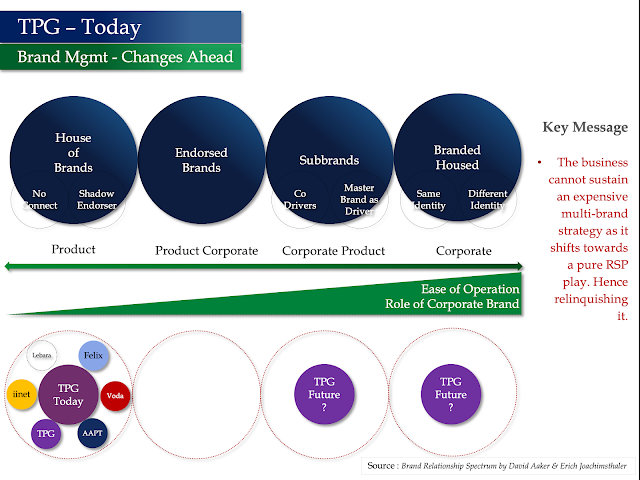

- The business cannot sustain an expensive multi-brand strategy as it shifts towards a pure RSP play. Hence abandoning it.

- The emerging trend of choosing Prepaid mobile over post-paid is reemphasised (MVNO Play). Post-paid ARPU increased primarily from the price rise in January and February.

- The mobile network is underutilised with just 3.2Mn post-paid mobile users compared to 6Mn for Optus and 9Mn for Telstra. This surplus capacity enticed them to go for the MOCN deal with Telstra.

- FW is cannibalising NBN and ADSL subscribers and improving its margin (bypassing NBN). About 0.5Mn premises are on FW. This is a growth area with an addressable market of around 20% of the Mobile Segment. 5G rollout of 3K sites by the EOY and 5K by 2025. 1 site requires 50 weeks to provision.

- With NBN EE's market-leading position in E&G, business is experiencing stickiness, incremental revenue and higher margin managed services (SD–WAN).

- Learnings from New Zealand in the Mobile segment are acting as a guiding force.

- IT Transformation (like single billing) has reduced impediments in P2O, O2A and RA, enabling agility in their GTM strategy.

Why is the Stock Price Flat?

TPG's share price has been flat at $5.47, with a marginal rise of 0.03c after HY23 results on August 24.

The critical reasons for this are:

- Growth in the Mobile segment because of roaming charges, rationalisation of plans and price increases to combat inflation.

- Growth in FW bypasses NBN and magnifies the margin.

- Growth in E&G supplemented by Fibre Fast and EE.

- The expected sale of the wholesale arm, Vision Stream, is seen as a value creator in the short term. In the longer term, TPG will face severe headwinds to sustain the business because selling a fortress (fibre infra) on which the business is built is not a good move.

- By focusing on pure RSP play in fixed access, the company has positioned itself as a semi-premium player, similar to Virgin Airlines. This strategic approach enables them to provide cost-efficient services without compromising on customer service. Hence, consolidating all the brands under one umbrella, streamlining their operations and enhancing their overall efficiency. This is uncharted territory for TPG as they will face competition from both high-end and low-end players.

- In the Mobile segment, they have an underutilised network, hence MVNO play will rise, and they may start exploring other network-sharing deals in the future.

- TPG is preparing itself for a challenging future.

My previous on NBN Co FY23 Results and its strategic play.

Source: AFR, TPG, ACCC, ITnews, Reuters, UBS

No comments:

Post a Comment