Featured Post

The Great Pricing Shift: How AI Is Breaking Traditional Revenue Models

------ 1. The Great Pricing Shift We're witnessing something unprecedented in business history: a fundamental reimagining of how comp...

Tuesday, August 10, 2021

Friday, August 06, 2021

Vodafone will get a lifeline from Retrospective Tax Withdrawl

Key Players in the Indian Telecom Industry

Vodafone Tax Issue Timeline

Key Issues and Arguments

- Vodafone acquired Hutchinson/Idea/Max in 2007 - 67% share by $ 11Bn

- Hutchinson Vamco, based out of HKG sold 67% of shares driven by assets in India

- Indian Tax Department called out that Vodafone has to pay Capital gains Tax (calculated as Rs 7K Crore in 2007, today it's Rs 20K Crore liability)

- Vodafone said the transaction was made by 2 foreign entities (Hutch/Vodafone) in a tax haven country

- When challenged by the Tax department, Vodafone went to the Supreme Court (SC) and won the case by saying that assets transferred in a foreign country can be taxed

- FM Pranab Mukherjee was hurt (probably ego) by this SC ruling, and hence he applied his power in the government and legislation to circumvent the SC ruling and prevent the tax from being backdated retrospectively

Removal of Retrospective Tax by the Indian Govt. will give a lifeline to Vodafone India, which is struggling financially in a JV with Hutch/Idea. The tax was ill-conceived by FM Paranb Mukjherjee, even though it was opposed at the time by PM Manmohan Singh and his cabinet colleagues like P Chidambaram and Kapil Sibal (law minister) in 2007. The tax was imposed from the backdate (can claim nearly 60 years) after Vodafone won the case in the Supreme Court (as described by Shekhar Gupta from ThePrint). By rolling out the retrospective tax, FM exercised typical abuse of power, intimidation, and legislative superiority to ensure Vodafone fell in line.

Why Vodafone is Indispensable

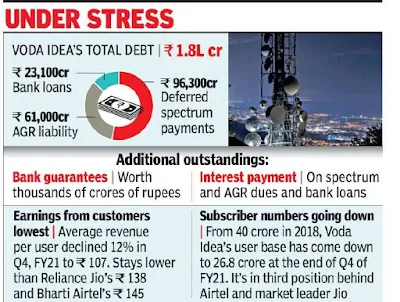

India has a few major players in the Telecom sector. The failure of any key player is detrimental to Telecom and is key to India's IT-driven Service Sector. Besides this, it will cause twin balance sheet issues for the financial sector as Indian Banks will lose their invested capital.

For Vodafone India, on the verge of bankruptcy in FY 22, Rs 20K crore liability will give a lifeline and infuse cash to survive in a capital-intensive industry during these challenging times, when the demand profile has changed.

India has a few major players in the Telecom sector. The failure of any key player is detrimental to Telecom and is key to India's IT-driven Service Sector. Besides this, it will cause twin balance sheet issues for the financial sector as Indian Banks will lose their invested capital.

For Vodafone India, on the verge of bankruptcy in FY 22, Rs 20K crore liability will give a lifeline and infuse cash to survive in a capital-intensive industry during these challenging times, when the demand profile has changed.

In short, this decision by the government is late, but sometimes politics can weaken strong leaders resolute to reform. As Shekhar Gupta (from ThePrint) called out correctly, if a mistake goes long, it does more damage, but it needs to be welcomed if it's corrected.

Credit: Shekhar Gupta from The Print, ET, The Hindu, WSJ.

Update on Liability for Vodafone India is around 60K crore, (share price is around - Rs7).

India's telecom sector is mismanaged by bureaucrats and is destroyed by some of the ludicrous policies on taxation, like AGR for spectrum. The amount of money owed to the government and banks by 3 telco companies (VI, Airtel) is around 1Lakh crore. The government needs to assist this sector, which has laid the pathways for the future. Time is running out before it's too late.

Wednesday, August 04, 2021

Brief Context and Background on Sales

Sales

Origin

Word sale came from the old English word sala - "a sale, act of selling", which originated from a Scandinavian source such as Old Norse sala, which originated from Proto-Germanic source "salo". The use of this word first appeared in texts around 1866, and by 1910 word Sales Representative was defined.

Definition

A sale is an activity between two or more parties in which the buyer receives tangible or intangible commodities, services, or assets in exchange for money. It is a commitment between the buyer and the seller to be exchanged for monetary consideration. When this activity is repeated multiple times for goods, it is defined as a Sale.

Sale is a successful transaction between a buyer and a seller reaching a zone of potential agreement (ZOPA). The interaction between the two individuals or parties underpins the success of this transaction. If two individuals are comfortable interacting with each other, they will transact or do business. In other words, relationships play an essential role in closing a sales transaction.

Sales Today

Today, a sale can be executed in multiple ways through a direct, indirect, electronic, agency, B2B, B2C and other channels. With the rise in technology adoption underpinned by digital enablement, sales in B2B and B2C segment is becoming more technology-enabled and less human-centric. However, buyers in the B2B domain still prefer human interactions for complex and large deals.

In the context of business, sales are the lifeline of any business, and to succeed in B2B sales or convincing others, one must learn how to navigate other people's mind.

Beyond Sales

Today selling has become an integral part of our daily life because we sell every day to others. How to influence and win over others is a skill that is fundamental to success in life and every task we undertake. Selling is everyone's business, and this is something that is not taught in any school. To succeed, the art of sales needs to be learned and practiced from early childhood.

Subscribe to:

Comments (Atom)