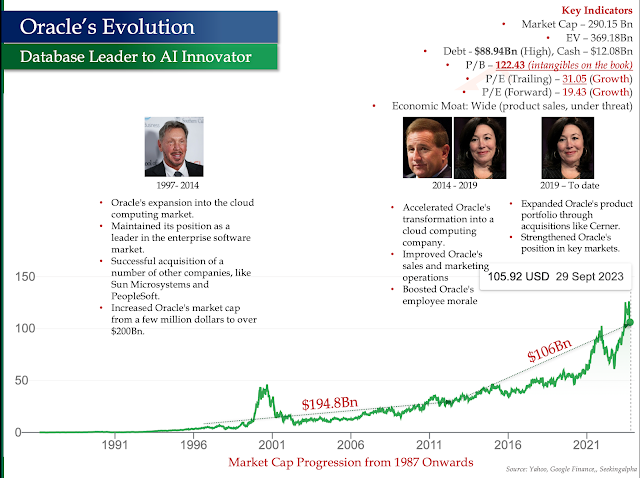

Oracle's Evolution - Database Leader to AI Innovator

- Market Cap – 290.15 Bn

- EV – 369.18Bn

- Debt - $88.94Bn (High), Cash – $12.08Bn

- P/B – 122.43 (intangibles in the book)

- P/E (Trailing) – 31.05 (Growth)

- P/E (Forward) – 19.43 (Growth)

- Economic Moat: Wide (product sales, under threat)

- Domain: Enterprise Software and Database

- Comp. (Business Apps) – IBM, SAP, Workday, MSFT, Salesforce

- Comp. (Database) – MongoDB, MySQL, Cassandra, AWS, Azure, IBM

- Growth Segment – OCI (Up)

Oracle's Facing Headwinds - In the Age of No SQL

The emergence of Digital Transformation in the early 2010s has brought multiple challenges to Oracle's relational database segment.

Today, it is facing stiff competition from both commercial and open-source vendors. It must constantly innovate and create new products and services to stay ahead of the database market. Despite the challenges, it is rising to the occasion by developing its own cloud-native database products and investing in artificial intelligence and machine learning to enhance the intelligence and autonomy of its databases.

Oracle - Where is the Growth

Oracle Nvidia Partnerhip

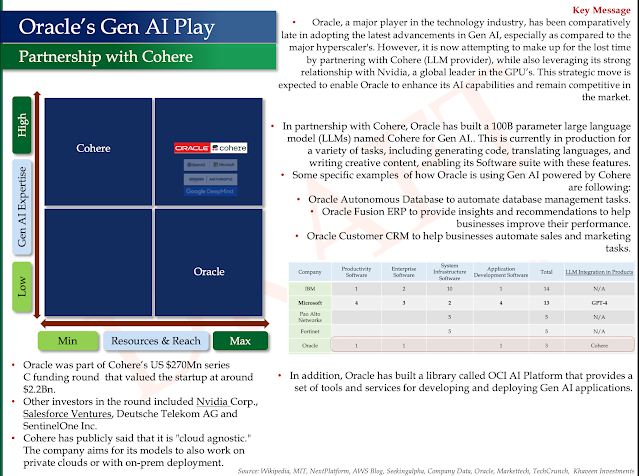

Oracle's Gen AI Play - Partnership With Cohere

Oracle, a major player in the technology industry, has been comparatively late in adopting the latest advancements in Gen AI, especially as compared to the major hyperscalers. However, it is now attempting to make up for the lost time by partnering with Cohere (LLM provider), while also leveraging its strong relationship with Nvidia, a global leader in the GPUs. This strategic move is expected to enable Oracle to enhance its AI capabilities and remain competitive in the market.

My other posts on Generative AI and Strategic Analysis of Key Players

- AI Value Chain

- TSMC - The Chipmaker That Runs The World

- Amazon the King of Retail -WhyAWS is the Crown Jewel

- Microsoft the King of AI in Software, Salesforce under the AI Cloud

- Tesla - It's not a Car, Its an AI Device on Wheels

- Google the King of Search - What the Future Beholds in the AI World

- Nvidia Godfather of AI - Why the Market is Bullish

- Generative AI can transform Telecoms, Energy and Utilities

Source: SeekingAlpha, Bloomberg, Martinfowler.com, Databricks.com, Nvidia, Google, AWS, Fourweek MBA Blog, Amazon, Ashwath Damodaran, TSMC

No comments:

Post a Comment