Featured Post

The Great Pricing Shift: How AI Is Breaking Traditional Revenue Models

------ 1. The Great Pricing Shift We're witnessing something unprecedented in business history: a fundamental reimagining of how comp...

Saturday, April 01, 2023

Saturday, March 11, 2023

Telecom Engagement Model for Private 5G

Telecom Engagement Model for Private 5G

- Private 5G is about transforming business operations and driving new revenue opportunities via the application layer.

- Telcos are adopting different engagement & deployment models for Private 5G.

- An increase in the footprint across the engagement value chain leads to an increase in the complexity but reduces time to market

- Jio in India is heading for end-to-end value chain control

- The ecosystem is getting more complex as partners are also competitors.

- Retail – Sell directly to Enterprise

- Retail – Sell via Partners like HPS

- Wholesale - become Wholesale provider

Friday, March 03, 2023

Wednesday, March 01, 2023

Sellers from Mars and Buyers from Venus - Nurturing, Calm, and Stable Seller and Buyer

Persona Mapping with Elements - Buyer and Seller

One of the critical activities and constituents of a sales plan is to build the buyer's stakeholder persona that will assist in the relationship-building process. Mapping of these stakeholder personas reveals the type of levers that can be used to develop and nurture long-term relationships with the intent of winning and expanding the sales pipeline. Without the intelligence of the buyer's persona, the sales execution effort will be challenging and profoundly inefficient and ineffective.

Besides, it addresses the risk of losing a sales representative because by capturing and documenting the buyers' persona, you can ensure that gathered intelligence and levers applied in building relationships and influencing negotiations are not lost with a change in guard at the sellers' end.

The bond between mother and child is everlasting; similarly, these natives are regarded as bondsmen for their friends and family members. People can count on them for their support during challenging times. In sales, these people protect their team members when a deal is lost.

Tuesday, February 28, 2023

Friday, February 24, 2023

Big Mac Test for Price Check on Internet Services in Australia

Big MacTest for Price Check on Internet Services in Australia

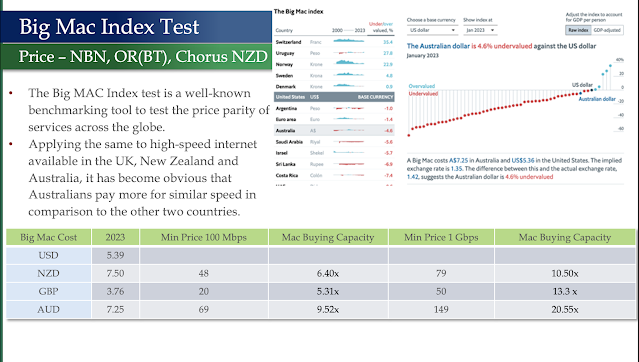

- The Big MAC Index test is a well-known benchmarking tool to test the price parity of services across the globe.

- Applying the same to high-speed internet available in the UK, New Zealand and Australia, it has become obvious that Australians pay more for similar speed in comparison to the other two countries.

Wednesday, February 22, 2023

Optus on Recovery Path from Cyber Security Attack

Has Optus on Recovery Path from Cyber Security Attack

Quick Snapshot of the Performance:

- Optus is facing multiple challenges. While it was trying to recover from the losses it suffered during the COVID pandemic, it was impacted by a data hacking issue in September 2022.

- This incident has shrunk their brand equity, and customers have lost faith. Hence, 65K customers have churned; in particular, the Mobile business suffered at least in the short term.

- Optus have recovered from its loss of 65K in 1-2 quarters, which is not only surprising but commendable. It is worth pointing out that the price rise has assisted in cushioning the effect.

- Having said that, the data hack has impacted their brand equity and has further strained their finances and balance sheet.

- Singtel board and exec team need to make a call if they can recover the brand equity or if it is time to rebrand or sell the business, or increase its MVNO or white label, like Amaysim.

Q3 FY23 Story from Numbers

- Impact of cyber attack contained within Q3FY23, positive net connections from Dec 2022.

- Revenue has slipped, not a surprise, with 65K subscribers lost to the competition and recovered, so to get new customers and win back a lot of incentives (like price discounts) had to be given, hence this impact (revenue numbers are not shared, only % is highlighted).

- EBITDA has improved, driven by growth in mobile & fixed, assisted by the price rise in Q2 and recovery in roaming.

- Cost synergies from Optus Enterprise integration.

- Amaysim is leading the AU MVNO market.

- The cyber attack's impact (Sep 22, 2023) is addressed at a war pace.

- The no of subscribers lost (65K) is not seen in the final numbers.

How the Singtel Stock is Performing

PE is above the global average and in the growth range, suggesting the stock has growth potential despite its downward trend.

Sunday, February 19, 2023

Why Adanis Stock is Still Overpriced

PE today is 94. Before the Hindenburg report it was > 254.

Valuation Guru- @AswathDamodaran highlights his view on Adani stock.

According to him, the stock is overpriced even after the Hindenburg report impact. He values the stock for Rs 947. On Jan 1, 2023, the stock was trading at Rs 3858 and PE around 254.

Today the stock is trading at Rs 1719 and a PE of 94.

Background:

Adani Group which was established in 1984 has become a conglomerate of infrastructure companies in sectors like airports, shipping, logistics, power generation (solar), and defence.

It's well established that infrastructure companies are about high volume and low margin, where with ageing returns get better, unlike telecom where returns diminish with ageing. While the Adani group had an astronomical rise from 2021 onwards where revenue grew by 112.70%, its margins were low at 3.4%, which is on the lower side as compared to other companies in this sector.Adani group has built a good reputation for executing on time like commissioning the largest hybrid power plant in 9 months or successfully managing the Mumbai airport. To date, all the companies in different verticals have been managed well and the market has put faith in them.

Rise and Connection to PM Modi:

Adani and his family's close connection with Prime Minister Narendra Modi go back to when Mr Modi was the CM of Gujarat from 2001 to 2004. Today the opposition parties claim that the growth of the Adani group (venture into defence, airports, and power) is indirectly driven by his proximity to PM Modi. Gautam Adani, the chairman of Adani Group became the 2nd richest person at the beginning of 2023.

There is an element of truth in this narrative and that can be highlighted by a few examples.

PM Modi is a doer but likes to control things so that he can execute things the way he wants. He tends to select the same people for new assignments with whom he worked successfully in past (like Gujarat). Ex the architect of the new Parliament and Kashi Vishwanath Corridor is the same person who built the new secretariat of Gujarat, he handpicked the CM of Haryana with whom he worked as a prachaark. Similarly, he picked the Adani group for multiple new projects because he trusts them in delivering the way he wants (large scale, excellence, timely execution, courage). This is in line with his working style and persona, which can be read in my book or here.

Fast Forward to Feb 2023:

With this background on Adani and their close connection to the Government why the stock is trading at a PE of 94 when most infrastructure companies at the most will trade at a PE of 15-25 at the most?

The answer to this lies in the opinion made by the market (fund managers, analysts) that, for the Adani group to grow at a rapid pace it needs the blessing and support of the current government in particular the PM. With only 15 months left to the next general election and opposition in disarray. It is clear that the market is factoring in that PM Modi is going to win the next general election and will come back as PM in 2024. This way the group's growth will be unhindered until 2029. In the stock market time span that's a good period to invest and make money.

Similarly, Aswath Damodaan has an interesting conclusion on Adnai's stock valuation which is worth pointing out.

Even with a further share drop, I am not tempted to buy shares in Adani companies, and it has little to do with the Hindenburg report. I have likened buying shares in a family group company to getting married, and then having all of your in-laws move into the bedroom with you. Investors in family group companies, no matter how honorable the family, are buying into cross holdings, opacity and the possibility of wealth transfers across family group companies. Those risks increase, if the family group companies are built around political connections, where you are one political election loss away your biggest competitive advantage. It is true that at the right price, I would be willing to expose myself to those risks, but it would require a significant discount on intrinsic value, and we are not even to close to that point yet. In short, I will watch this tussle between the Adani Group and Hindenburg from the sidelines, with less interest in the firm and more in what changes it may (or may not) bring to business, investing and regulatory practices in India.

Finally, I can't make sense of any other economic reason, why the stock is still overpriced at Rs 1719, other than what I have outlined above.

Friday, February 17, 2023

How NBN Could be Profitable in FY25

How NBN Could be Profitable in FY25.

Background:

- Losses are booked for the last 6 years and are anticipated to continue until FY24.

- Depreciation and Amortisation are a drag on the NPAT and will continue in the $2.9-2.5 Bn range.

- WACC will be around >=2.97%

- Revenue increase (less idle network) is assumed to be 4-5% YoY.

- Cost is anticipated to increase by 5-6% in FY23 and FY24.

- Increase the wholesale price via SAU

- Reducing the serviceability of debt (this is now executed, where serviceability has been reduced from $1.47 Bn to $0.37 Bn per year)

- migrating <= 50 Mbps tiered users (78%) to >=100 Mbps high-speed internet,

- by applying these levers, it can book a profit (NPAT) in FY25, even with a 25% idle network.

My previous post on why the government is worried about NBN after FY23 H1 results can be read here

Wednesday, February 15, 2023

Todays NBN Result is Worrying for the Government

H1 FY23 NBN result is worrying for the government.

Reason:

- The uptake by new subscribers is nearly stagnant at 85Mn connected premises (same as FY22) and is moving at a snail's pace.

- With NBNs net growth being negligible, suggesting forces of attrition are at play and with 10K customers switching to Starlink, it is not helping its cause either.

- NBN is facing severe headwinds from 5G, Starlink and other fixed-line players, hence there is a twofold push by them. One is to increase the wholesale price and the second is to get regulatory protection from ACC to guard their market share against 5G and other players.

- Today if NBN is sold it will get a price of $19 to $25 Bn (the lower end is realistic) which is less than the contributed equity of $29.5Bn.

- The government has committed to the electorate that it will upgrade FTTN/B to FTTC/P and increase the penetration of high-speed internet and make it affordable. Their intent is to make high-speed internet in Australia to be at par with OECD countries and get recognised as a leader in the digital enablement of the economy. Hence they have shelved the privatisation plan until 2025 or the next election.

- With today's number, the longer the government wait, there is no guarantee that this nation-building asset facing heat from the market forces will command a higher sales price. In fact, the risk is, that it might be sold at a lower price, putting more pressure on the government's off-balance sheet item

(off-budget spending driving inflationary) - Having said that, by delaying privatisation government will fulfil its promise to the electorate in 20202 by enhancing its global internet ranking, high-speed penetration and CX.

The good news is:

- The good news in all this is that their EBITDA margin has increased from 58% to 69% (the highest in the telecom ecosystem ) underpinned by milking high-speed tier (Pricing strategy is working), increasing business penetration and reducing OPEX (like subscribers cost).

Monday, February 13, 2023

Telecom Industry Evolution - 1990 to 2023

Telecom Industry Evolution - 1990 to 2023

Tuesday, February 07, 2023

Why the Government had to intervene in Vodafone Idea

Why the Government had to intervene in Vodafone Idea

Thursday, February 02, 2023

Open AI - Why Google is Threatened

Open AI - Why Google is Threatened

If search without AI was an order of complexity - one, then search with AI is like an order of complexity two. Google is now launching its own #AI chatbot - BardAI which will respond to complex queries instead of simple questions served by google doodle. AI is now venturing into more complex tasks; hopefully, more players will participate and emerge.

More info on Open AI can be found here