Palo Alto Networks - Leader in Cyber Security

Key Indicators

- Market Cap – 73.07 Bn

- EV – 72.95 Bn

- Debt - $2.26Bn

- P/B – 41.79 (Goodwill from M&A)

- P/E (Trailing) – 184.99 (Growth)

- P/E (Forward) – 44.44 (Growth)

- Economic Moat: Wide (product, innovative)

- Palo Alto Network provides network security solutions. The company's solution offerings spread across network security, cloud-native application protection, security operations, and endpoint security and are available across multiple key industries.

- Cybersecurity has 5 stage lifecycle - Identify, Protect, Detect, Recover and Restore. This cyclical process is essential for protecting an organisation from cyber threats. It helps to ensure that corporations are constantly prepared and able to respond to evolving threats.

Dominating Growth Strategy

Since Nikesh Joined as CEO in 2018, Palo Alto Networks has grown with a CAGR of 24.9% with market cap. surging by $48Bn to $73.1Bn. This growth is spurred by M&A activity, improving the top line and ensuring it outpaces both competitors and potential security threats from hackers.

Palo Alto Networks has spent nearly $4Bn in acquiring 17 businesses, to form its Cortex and Prisma Cloud businesses, since its inception. The company has consistently demonstrated its commitment to driving integrated organic growth through mergers, acquisitions, and partnerships with several well-known startups. Time and again, the company has proven its capability to integrate these acquisitions to enhance or complement its own product offering.

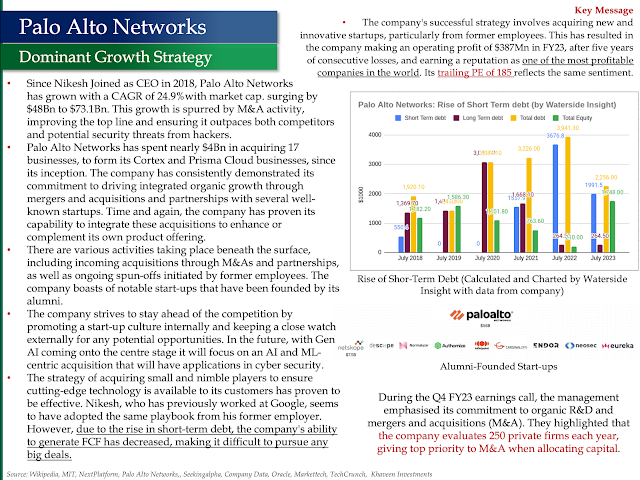

There are various activities taking place beneath the surface, including incoming acquisitions through M&As and partnerships, as well as ongoing spin-offs initiated by former employees. The company boasts of notable start-ups that have been founded by its alumni.

The company strives to stay ahead of the competition by promoting a start-up culture internally and keeping a close watch externally for any potential opportunities. In the future, with Gen AI coming onto the centre stage it will focus on an AI and ML-centric acquisition that will have applications in cyber security.

The strategy of acquiring small and nimble players to ensure cutting-edge technology is available to its customers has proven effective. Nikesh, who has previously worked at Google, has adopted the same playbook from his former employer. However, due to the rise in short-term debt, the company's ability to generate FCF has decreased, making it difficult to pursue any big deals.

My other posts on Generative AI and Strategic Analysis of Key Players

- AI Value Chain

- Amazon the King of Retail -WhyAWS is the Crown Jewel

- Microsoft the King of AI in Software, Salesforce under the AI Cloud

- Tesla - It's not a Car, It's an AI Device on Wheels

- Google the King of Search - What the Future Beholds in the AI World

- Nvidia Godfather of AI - Why the Market is Bullish

- IBM - How it Lost Its Way

- Generative AI can transform Telecoms, Energy and Utilities

No comments:

Post a Comment