India China Strategic Play - Striving for Growth and Leadership

Featured Post

The Great Pricing Shift: How AI Is Breaking Traditional Revenue Models

------ 1. The Great Pricing Shift We're witnessing something unprecedented in business history: a fundamental reimagining of how comp...

Tuesday, September 05, 2023

Monday, September 04, 2023

Telecom Companies using Generative AI Globally

Telecom Companies using Generative AI Globally

Companies in the telecom sector are exploring and implementing AI generative technologies for various applications. However, please note that the landscape of AI usage in the telecom sector is rapidly evolving, and new companies may have emerged or existing ones may have expanded their AI initiatives since then. Here are some examples of companies that were known for using AI generative technologies in the telecom sector:- AT&T: AT&T has been actively utilising AI for network optimisation, customer service, and predictive maintenance. They have employed AI-driven generative models to optimise network traffic and improve the overall customer experience.

- Verizon: Verizon has been exploring AI and machine learning for network optimisation, fraud detection, and customer service. AI generative models are used to generate synthetic data for testing and validating network configurations.

- Vodafone: Vodafone has been using AI to enhance customer experience and network management. Generative AI is used to predict network outages and optimise network performance.

- Ericsson: Ericsson, a major telecom equipment provider, has been incorporating AI generative models into its solutions to automate network management tasks and improve network performance.

- Huawei: Huawei has been investing in AI and machine learning for network optimisation and cybersecurity. They have explored generative models to enhance network security and predict network anomalies.

- Nokia: Nokia has been leveraging AI generative models for network automation and predictive maintenance. They use generative AI to analyse network data and generate insights for optimising network infrastructure.

- Telefonica: Telefonica, a Spanish multinational telecommunications company, has been using AI and generative models for network planning, optimisation, and customer service improvements.

- Cisco: Cisco has been incorporating AI into its networking solutions, including AI generative models for network automation and security.

- T-Mobile: T-Mobile has explored AI generative models to improve customer service and network performance, including predictive maintenance of network infrastructure.

- Orange: Orange, a French multinational telecommunications corporation, has been using AI and generative models for network optimisation and to enhance customer experience.

- In Australia, Telstra, TPG, and Singtel are in the early stages of discovery.

Aussie Broadband's FY23 Results

Aussie Broadband's (ABB) FY23 Results and Why it's Emerging as an Acquisition Target

- NBN

- Consumer

- 2019, 100K customers, unprofitable.

- 2023, 700K customers, NPAT of $37Mn.

- 65% of Revenue from the consumer segment.

- 12% of NBN customers are on > $100/month plan and 40% of Aussie customers are in this segment. Aussie acquires more than half of all new high value subscribers to the NBN.

- Business & Govt

- Business segment grew by 8% to $90Mn Rev. EE is adding to margin growth

- >800 new deals – SMB is driving it

- Both segments utilise wholly owned fibre and an internally built cloud platform to generate 50% GM against residential GM of 30%. As those segments grow, profits will disproportionately rise.

- Smallest telco to build its own fibre backhaul.

- Built in house software to manage data loads, billing and other core functions.

- Wholesale

- business offers white labelled telco services to 3rd parties like Origin, was its fastest growing segment and a genuine surprise. Revenue rose 60% to over $100Mn and maintained 30% GM. Management expects margins to rise as more partners use the service.

- Cloud

- With 2 new data centres added to the business, growing fibre and a bespoke cloud platform, there is little doubt that Aussie aims to build a capability to sell cloud services to enterprise and government.

- This is ambitious and chances are this will fail. Globally Telcos have struggled with Cloud as HPS’s and Tier 2 Cloud players are far ahead in the game.

- ABB is to become a billion-dollar business in the next 2 years.

- Healthy balance sheet.

- Currently, the EV is $0.946 Bn and with good growth potential for Rev and Margin growth in the next 2-3 years.

- The market share of NBN is around 8%.

My previous on TPG and NBN Co FY23 Results and its strategic play.

Source: AFR, TPG, ACCC, ITnews, Reuters, ABB, UBS

The Value Chain for Generative AI (Artificial Intelligence)

Response from ChatGPT (Generative AI Tool)

- Research and Development (R&D): This is where the foundational work on generative AI takes place. Researchers and data scientists work on developing algorithms, models, and techniques for generative AI. This includes areas such as neural networks, deep learning, and reinforcement learning.

- Data Collection and Preparation: High-quality data is crucial for training generative AI models. This step involves sourcing, cleaning, and preparing datasets that the AI models will learn from. Data collection can involve structured data, unstructured data, or a combination of both.

- Model Training: In this stage, generative AI models are trained on the prepared data. This involves using machine learning frameworks and powerful hardware to optimize and fine-tune the models. Training may require significant computational resources.

- Model Validation and Testing: After training, the models are rigorously tested and validated to ensure they perform as expected. This includes assessing their accuracy, reliability, and

generalization capabilities. - Deployment and Integration: Once the models are ready, they are integrated into real-world applications. This can involve deploying them in cloud environments, on edge devices, or within specific software systems.

- Application Development: Developers and engineers build applications and solutions that leverage generative AI models. These applications can span various domains, such as natural language processing (NLP), computer vision, recommendation systems, and creative content generation.

- User Interaction and Experience: The end-users interact with the generative AI-powered applications. The user experience, including user interfaces and user-friendly interactions, plays a significant role in delivering value.

- Monitoring and Maintenance: Continuous monitoring of generative AI models and applications is essential to ensure they continue to perform well and adapt to changing data patterns. Maintenance and updates are regularly performed to address issues and improve performance.

- Data Security and Privacy: Protecting sensitive data and ensuring privacy compliance is a critical part of the generative AI value chain. This includes data encryption, access controls, and compliance with data protection regulations.

- Value Capture: Organisations generate value from generative AI through various means, such as subscription models, licensing, consulting services, or direct sales of AI-powered products.

- Feedback Loop and Improvement: Continuous improvement is key to the generative AI value chain. Feedback from users and performance metrics are used to refine models and applications over time.

- Ethical Considerations and Compliance: Ensuring ethical and responsible AI practices is crucial. This involves addressing bias, fairness, and ethical concerns associated with AI technologies and adhering to regulatory requirements.

- Research and Innovation: The insights gained from real-world usage and feedback can inform further research and innovation in the field of generative AI, leading to the development of more advanced models and applications.

The generative AI value chain is a dynamic process that involves multiple stakeholders, from researchers and data scientists to developers, users, and business executives. Successful implementation of generative AI can lead to a wide range of applications across industries, from healthcare and finance to entertainment and customer service.

My other posts on how Generative AI can transform Telecoms, Energy and Utilities

Source: Seekingalpha, Bloomberg, Martinfowler.com, Databricks.com Linkedin, Google, AWS

Friday, September 01, 2023

How to Analyse if the Business is Growing

- This 2x2 matrix is plotted to identify if the business is growing organically.

- X-Axis has Revenue Contribution which is the additional contribution from the previous comparison (like year or qtr)

- Y-Axis X has EBITDA Contribution which is the additional contribution from the previous comparison (like year or qtr)

- In essence, when both contributions exhibit a downward trend, it can be inferred that the enterprise is undergoing a decline in terms of expansion and stability.

- When the contribution to revenue is declining, but the contribution to EBITDA is growing, the business is still able to increase its EBITDA contribution despite shrinking. In other words, it is extracting more margin from a declining entity

- When revenue contribution increases while EBITDA contribution decreases, it indicates that the business is growing, but its EBITDA contribution is under pressure. As a result, margins are facing fierce competition.

- The simultaneous growth of revenue and EBITDA is a reliable indicator of a robust and rapid business expansion. This signifies a positive trend in the company's financial performance and can be viewed as a favourable development by stakeholders.

Sunday, August 27, 2023

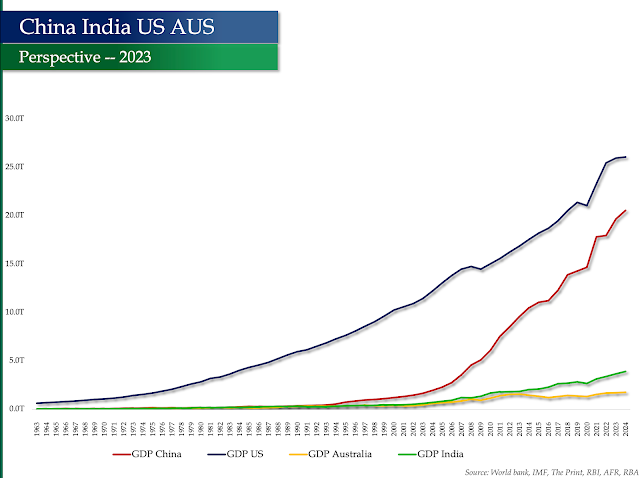

India and China's Dilemma

India and China's - Game of Thrones via Economic and Political Lens

Indias Conundrum

India is playing its part in the BRICS because of the following

India's trust in China has eroded due to 4 skirmishes at the Northern Border. India is wary of China's growing clout in the new world order. While BRICS is economically China-centric, it is ensuring that it doesn't become a Unipolar bloc in Asia and another India-bashing group like OIC used to be. India can no longer rely on Russia as it has been forced to become China's ally because of sanctions.

By consenting to an expansion, it is mounting pressure on China and other relevant parties to acknowledge its deserving position in the UN's Permanent Five + Group and refrain from raising objections.

Besides India's trade deficit with the New BRICS being around 69%, prompting a need for effective management. In response, India is seeking to promote the use of local currency in trade transactions, thereby reducing its reliance on the USD and conserving Forex reserves. Furthermore, UAE has agreed to do business in Indian Rs, a significant development in this regard.

In light of the ongoing conflict in Ukraine and the economic impacts of COVID-19, the New BRICS bloc, which now includes Argentina, Iran, Ethiopia, Egypt, UAE, and Saudi Arabia, is expected to have a combined GDP of $29.14 Tn. The New BRICS bloc has a population of 3.6 Bn, which accounts for 51.6% of the world's population, while G7 has a population of only 0.8 Bn, which accounts for only 10.9% of the world's population.

--

Why China Wants to Invade Taiwan

- China has been threatening to invade Taiwan, claiming it as part of its One China policy due to cultural and historical reasons.

- Being a highly authoritarian country with minimal democratic values, it cannot afford to have an island nation located merely 150 kilometers away from its mainland that practices democracy.

- Taiwan holds a prominent position as the global leader in the semiconductor industry, with TSMC as its flagship company. Today Semiconductors are crucial components in the defense, space, and technology sectors.

- China's trade deficit is exacerbated by its reliance on Taiwan for advanced semiconductors, prompting it to seek industry dominance and supply chain control.

- The US, which has a $400Bn trade deficit with China, is preventing China from acquiring advanced semiconductor technology, fuelling further tension. Therefore, China has multiple reasons to invade, including cultural, political, and economic factors.

- Analysts argue that the US is feeling the pressure because they facilitated China's ascent as a manufacturing hub and are now seeking to diversify supply chains to mitigate risks in the post-COVID era.

- China's trade deficit with Australia is being driven by continued demand for its resources, while Australia post-COVID, is diversifying its import and export portfolio.

Saturday, August 26, 2023

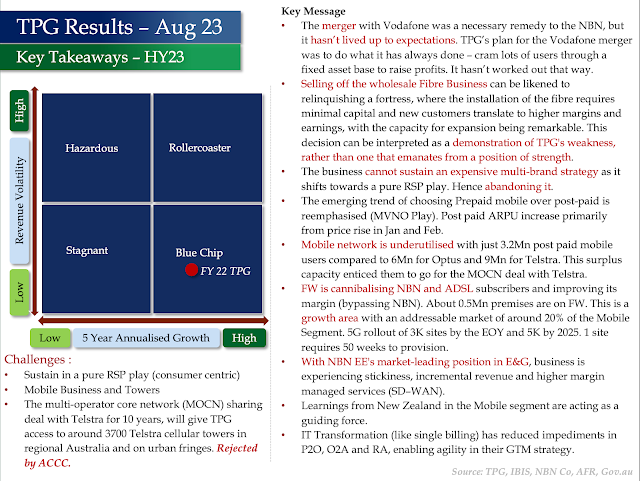

TPG Heading for a Challenging Future

TPG Heading for a Challenging Future

HY23 Results - Key Takeaways

-

- The merger with Vodafone was a necessary remedy to the NBN, but it hasn’t lived up to expectations. TPG’s plan for the Vodafone merger was to do what it has always done – cram lots of users through a fixed asset base to raise profits. It hasn’t worked out that way.

- Selling off the wholesale Fibre Business can be likened to relinquishing a fortress, where the installation of the fibre requires minimal capital and new customers translate to higher margins and earnings, with the capacity for expansion being remarkable. This decision can be interpreted as a demonstration of TPG's weakness, rather than one that emanates from a position of strength.

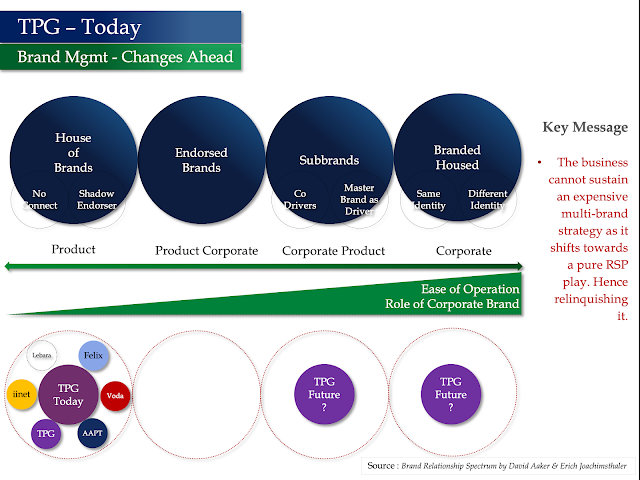

- The business cannot sustain an expensive multi-brand strategy as it shifts towards a pure RSP play. Hence abandoning it.

- The emerging trend of choosing Prepaid mobile over post-paid is reemphasised (MVNO Play). Post-paid ARPU increased primarily from the price rise in January and February.

- The mobile network is underutilised with just 3.2Mn post-paid mobile users compared to 6Mn for Optus and 9Mn for Telstra. This surplus capacity enticed them to go for the MOCN deal with Telstra.

- FW is cannibalising NBN and ADSL subscribers and improving its margin (bypassing NBN). About 0.5Mn premises are on FW. This is a growth area with an addressable market of around 20% of the Mobile Segment. 5G rollout of 3K sites by the EOY and 5K by 2025. 1 site requires 50 weeks to provision.

- With NBN EE's market-leading position in E&G, business is experiencing stickiness, incremental revenue and higher margin managed services (SD–WAN).

- Learnings from New Zealand in the Mobile segment are acting as a guiding force.

- IT Transformation (like single billing) has reduced impediments in P2O, O2A and RA, enabling agility in their GTM strategy.

Why is the Stock Price Flat?

TPG's share price has been flat at $5.47, with a marginal rise of 0.03c after HY23 results on August 24.

The critical reasons for this are:

- Growth in the Mobile segment because of roaming charges, rationalisation of plans and price increases to combat inflation.

- Growth in FW bypasses NBN and magnifies the margin.

- Growth in E&G supplemented by Fibre Fast and EE.

- The expected sale of the wholesale arm, Vision Stream, is seen as a value creator in the short term. In the longer term, TPG will face severe headwinds to sustain the business because selling a fortress (fibre infra) on which the business is built is not a good move.

- By focusing on pure RSP play in fixed access, the company has positioned itself as a semi-premium player, similar to Virgin Airlines. This strategic approach enables them to provide cost-efficient services without compromising on customer service. Hence, consolidating all the brands under one umbrella, streamlining their operations and enhancing their overall efficiency. This is uncharted territory for TPG as they will face competition from both high-end and low-end players.

- In the Mobile segment, they have an underutilised network, hence MVNO play will rise, and they may start exploring other network-sharing deals in the future.

- TPG is preparing itself for a challenging future.

Source: AFR, TPG, ACCC, ITnews, Reuters, UBS

Monday, August 21, 2023

Brand Value and Positioning Changes in Australia

Brand value and positioning changes in Australia.

Optus suffered from a data security incident in 2022, while Retailers dominate the top 10 and Auspost ranks surprisingly low.

Saturday, August 12, 2023

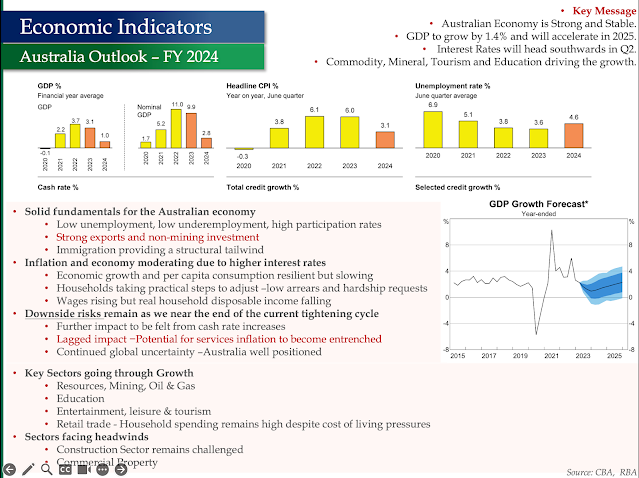

Australian Economic Outlook FY2024

Australian Economic Outlook FY2024

- The Australian Economy is Strong and Stable.

- GDP is to grow by 1.4% and will accelerate in 2025.

- Interest Rates will head southwards in Q2. Commodity, Minerals, Tourism and Education driving the growth.

Friday, August 11, 2023

NBN Co FY 23 Results - Key Takeaways

NBN Co FY 23 Results - Key Takeaways

--

- NBN Co’s Revenue has increased by 4% in FY23 and is facing headwinds for increasing revenue.

- CAGR stands at 8.7%. WACC - 3.18% (heading upwards)

- Has the highest EBITDA margin (68.2%) among telcos globally.

- Consumer uptake is at a snail's pace, with only 40K net additions in the last 12 months.

- 12.3 Mn customers ready to connect

- 8.56 Mn are active (30% idle network)

- 6.64 Mn (78.2%) users are on <= 50 Mbps

- 2 Mn (24.2%) users < 50 Mbps, 4.52 Mn users on 50 Mbps

- 1.83 Mn (20.7%) users are on >= 100 Mbps (risen by 2%)

- 6.6 Mn premises ready for Ultrafast (incl 2.5 Mn on HFC)

- Poor uptake – only 50-60K has been upgraded

- In all, 1.83 Mn users are using Ultrafast (>=100 Mbps) internet.

- Facing heat from Starlink and 5G providers in remote areas

- Starlink in Australia > 120K subscribers

- Sky Muster has declined from 108K to 96.1K

- In the Enterprise 35K EE SIOs are active.

- It seeks to improve its top and bottom line by implementing price increases through the SAU. The next revision is to be submitted soon.

- Today ARPU is $47 (Residential, stagnant), and FY24 ARPU is $49 (sub-SAU approval)

- Heading for profit (NPAT) without a soft write-off of $32 Bn in H1 FY25. With the write-off, it could be Profitable in FY 24.

- NBN’s Enterprise Value has risen from $25 - $19 Bn to $36 - $29 Bn and will be heading northward of $40 Bn if SAU with a price increase is accepted in FY24. A good prospect for the government as it prepares to offload its investment after FY25.

- The total cost of ownership TCO of NBN in 2023, using ICRA, is A$76Bn+, and without ICRA consideration, it is >A$59.9BN

--

- NBN was established to reduce the digital gap in Australia by making high-speed internet (>100 Mbps) affordable and removing Telstra's monopoly in fixed-line access. While NBN has succeeded in removing Telstra's monopoly, it's disheartening to see that they have failed to reduce digital exclusion by providing affordable high-speed internet.

- After investing A$76Bn over 14 years, Australia's average fixed internet speed ranks 81st globally at 53 Mbps, lagging behind many other countries in terms of internet connectivity.

- 75% of Australians are consuming the internet at a speed of 50Mbps or less.

Friday, August 04, 2023

How Digital Transformation can Transform Energy and Utilities

Response from GenAI tool ChatGPT:

--

The transformation of the energy and utilities sector is a complex and ongoing process driven by technological advancements, environmental concerns, changing consumer expectations, and regulatory changes. This transformation is often referred to as the "energy transition" or "utility transformation." Here are some key ways in which the energy and utilities sector can transform:

- Transition to Renewable Energy: One of the most significant transformations in the energy sector is the shift from fossil fuels to renewable energy sources like solar, wind, and hydropower. This transition reduces greenhouse gas emissions and promotes sustainability.

- Decentralisation: Traditional energy systems were centralised, with power generated at large power plants and distributed through a grid. The future of energy includes more decentralised systems, where individual homes and businesses generate their own power through solar panels and wind turbines. This is known as distributed energy generation.

- Smart Grids: The development of smart grids enables more efficient and reliable distribution of electricity. Smart grids use digital technology to monitor and manage the flow of electricity, optimise energy usage, and integrate renewable energy sources seamlessly.

- Energy Storage: Advances in energy storage technology, such as batteries, are crucial for the integration of intermittent renewable energy sources. Energy storage helps balance supply and demand, ensuring a stable energy supply even when the sun isn't shining or the wind isn't blowing.

- Electrification of Transportation: The transportation sector is gradually transitioning from internal combustion engine vehicles to electric vehicles (EVs). This shift creates opportunities for utilities to provide EV charging infrastructure and manage increased electricity demand.

- Energy Efficiency: Utilities and consumers are placing greater emphasis on energy efficiency measures, from energy-efficient appliances and buildings to industrial processes. This reduces energy waste and lowers overall energy consumption.

- Grid Resilience: Climate change and extreme weather events pose a threat to energy infrastructure. Utilities are investing in grid resilience to ensure the continued delivery of electricity even in adverse conditions.

- Customer-Centric Services: Utilities are focusing on improving customer experiences by offering services like real-time energy consumption data, flexible pricing plans, and energy-saving tips through digital platforms.

- Regulatory Changes: Government policies and regulations play a crucial role in driving energy and utilities transformation. Regulations may incentivise renewable energy adoption, set emissions reduction targets, or mandate energy efficiency standards.

- Emerging Technologies: The adoption of emerging technologies like blockchain for energy trading, artificial intelligence for grid optimisation, and quantum computing for advanced energy modelling can further transform the sector.

- Environmental Sustainability: Utilities are increasingly committing to sustainability goals, including reducing carbon emissions and transitioning to carbon-neutral or carbon-negative operations.

- Community and Microgrids: Smaller-scale energy systems, such as microgrids, can provide localised energy resilience and support communities during power outages.

- Partnerships and Collaboration: Collaboration between utilities, technology companies, governments, and research institutions is essential to accelerate the transformation and share best practices.

The transformation of the energy and utilities sector is a multi-faceted process that involves various stakeholders, from governments and utilities to consumers and technology providers. It is driven by a combination of economic, environmental, and technological factors, and it will continue to evolve as new innovations emerge and the world seeks sustainable energy solutions

--

Digital transformation is playing a pivotal role in reshaping the energy and utilities sector. It offers innovative solutions to improve operational efficiency, enhance customer experiences, and address sustainability challenges. Here's how digital transformation can transform the energy and utilities industry:

- Smart Grids: Digital technologies enable the development of smart grids that incorporate sensors, real-time data analytics, and automation. These grids enhance grid management, reduce energy losses, optimise energy distribution, and accommodate renewable energy sources more efficiently.

- Energy Management and Optimisation: Digital tools and data analytics help utilities better understand and manage energy supply and demand. Predictive analytics can forecast energy consumption patterns, enabling utilities to optimise energy generation and distribution.

- Grid Resilience: Digital technologies enhance the resilience of energy grids. Predictive maintenance using IoT sensors and analytics can identify potential equipment failures, reducing downtime and improving grid reliability, especially during extreme weather events.

- Renewable Energy Integration: Digital solutions help integrate intermittent renewable energy sources like wind and solar into the grid. Advanced forecasting, demand response, and grid balancing algorithms ensure a stable and efficient energy supply.

- Decentralised Energy: Digital platforms facilitate the deployment of decentralised energy solutions like microgrids and peer-to-peer energy trading. Consumers can produce, store, and sell excess energy, leading to more resilient and sustainable energy ecosystems.

- Customer Engagement: Digital transformation enhances customer engagement through online platforms and mobile apps. Customers can access real-time energy usage data, receive personalised energy-saving tips, and choose flexible pricing plans, promoting energy efficiency.

- Energy Storage Management: Digital tools monitor and optimise energy storage systems, such as batteries, for grid balancing and peak load management, increasing the reliability of renewable energy sources.

- Asset Management: Utilities use digital asset management systems to track the performance of infrastructure and equipment. Predictive maintenance based on data analytics reduces downtime and extends the lifespan of assets.

- Cybersecurity: As digitalisation increases, cybersecurity becomes critical. Utilities invest in cybersecurity measures to protect critical infrastructure from cyber threats, ensuring the security and reliability of the grid.

- Data Analytics for Sustainability: Digital platforms allow utilities to collect and analyse vast amounts of data related to energy production and consumption. This data is crucial for making informed decisions about sustainability goals, emissions reductions, and resource allocation.

- Electric Vehicle Integration: Digital infrastructure supports the growth of electric vehicles (EVs). Utilities can offer EV charging stations, manage EV charging load, and provide incentives for off-peak charging.

- Regulatory Compliance: Digital transformation aids in meeting regulatory requirements efficiently. Utilities can use data analytics to track and report on emissions, energy efficiency, and renewable energy integration to comply with environmental regulations.

- Energy Market Participation: Digital platforms enable utilities to participate in energy markets more effectively. They can engage in real-time energy trading, offering surplus energy to the grid during peak demand.

- Workforce Management: Utilities can use digital solutions for workforce management, scheduling, and training to improve field operations and response times.

- Supply Chain Optimisation: Digital tools assist in optimising the supply chain for equipment and materials used in energy infrastructure projects, reducing costs and lead times.

In summary, digital transformation empowers the energy and utilities sector to operate more efficiently, adapt to changing energy landscapes, reduce environmental impacts, and provide customers with enhanced services and experiences. It plays a vital role in shaping a more sustainable, reliable, and resilient energy future.

--

My post on How Telecoms Can Transform and Why Telcos are Struggling to Generate ROI

Thursday, August 03, 2023

Digital Services Landscape and Opportunity for Telecom in Australia

Exploring the Digital Services Landscape and Opportunities for the Telecom Industry in Australia.

- Financial Services across Insurance, e-commerce and Fintech have an addressable market of > $100 Bn and Telcos are eager to increase their wallet share to the mid-20s.

- The potential for growth in areas like IoT and Smart places is immense, with minimal infrastructure investment required in comparison to 5G.

- Private 5G and SD-WAN are currently in high demand across various industries including Mining, Tourism, Energy, Heathcote, and Supply Chain. These verticals are the focus due to their increasing need for advanced technological solutions.

Australia is Lagging in Internet Speed While Price is going Up

Australia is Lagging in Internet Speed While Price is Going Up.

There are valuable takeaways from New Zealand's fibre optic infrastructure rollout, which boasts faster speeds and more affordable pricing.

Saturday, July 29, 2023

Telecom Industry Australia - IT Opportunity for Software and Service Providers

Mapping of Tech Spend and Technology gives a good view of IT spending in 2023

\

\