Gen AI The New Reality - How Key Players Are Progressing

About the BookEmbark on a journey through the world of chipmakers, where TSMC reigns supreme, pioneering the most advanced chips, yet facing its unique challenges. Discover the driving forces behind Nvidia's dominance as the "Godfather of AI" and analyse the potential for a dot-com bubble resurgence.

Venture into the realm of Hyperscalers, where Microsoft stands as the undisputed king of AI in the cloud and software. Explore its strategic partnerships, the economics of training AI systems, and the inherent risks associated with its growth.

Delve into the world of Google, the search giant that's leveraging Gen AI to revolutionize its offerings. Examine its search economics, cloud play, diversification efforts, and the infamous $100 billion blunder.

Uncover the secrets behind Amazon's retail empire, where multiple flywheels drive its growth. Analyse the intricacies of AWS, the crown jewel of Amazon's offerings, and the company's pursuit of new flywheels.

Step into the automotive sector, where Tesla stands as a visionary leader, constantly reinventing its vehicles. Explore the company's secret sauce, its growth trajectory, its ambitious FSD plans, and the role of AI-enabled Dojo.

Discover how Oracle, the database leader, is transforming into an AI innovator. Understand the company's growth strategy, its focus on Gen AI, and the challenges it faces.

Dive into the world of Salesforce, a cloud and AI-powered CRM giant. Explore its growth trajectory, its evolving relationship with competitors, and the potential risks it faces.

Examine SAP, the ERP market leader, as it strives to become a one-stop shop for businesses. Understand the company's efforts to catch up with AI advancements and the challenges it faces.

Uncover the story of IBM, a tech giant facing growth hurdles. Analyse its history of misfires, its comprehensive AI play, and the factors that have led to its relative stagnation in recent years.

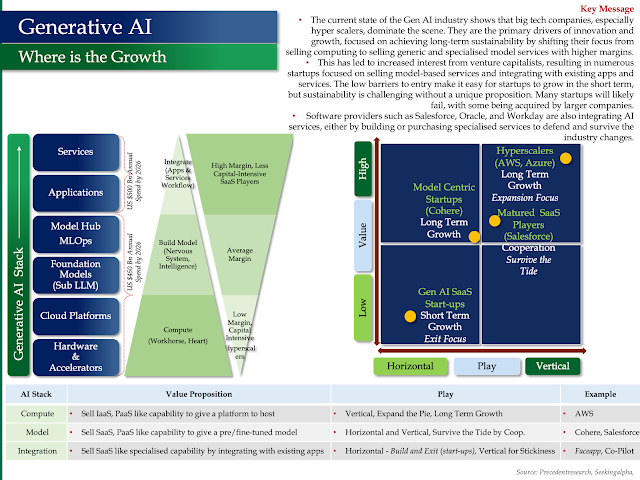

- Understand the evolution, hype, and potential of Generative AI.

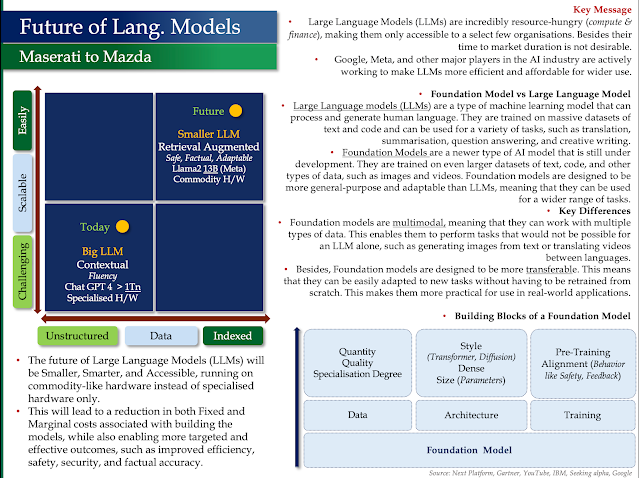

- Discover the value chain, deployment models, and future growth of LLMs.

- Analyse the dominance of chipmakers like TSMC and Nvidia.

- Delve into the AI strategies of Hyperscalers like Microsoft, Google, and Amazon.

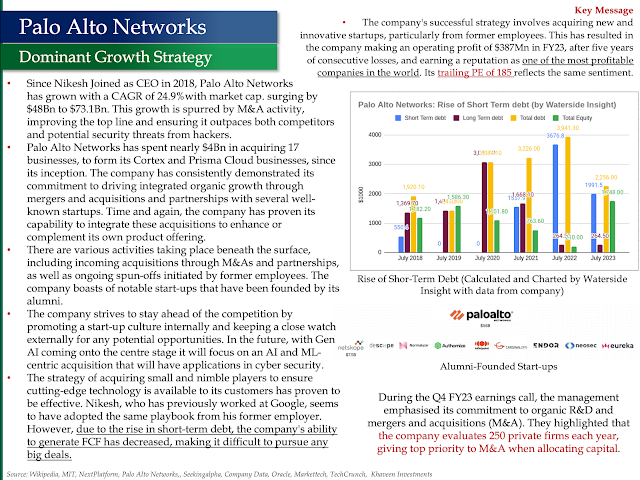

- Explore the AI innovations of automotive, software, and security companies.

- This book provides a comprehensive overview of the Generative AI landscape, equipping readers with the insights needed to navigate this transformative era.